Displaying Tables With gt

1 Objectives

This section covers the gt package for displaying data in tables in your R Markdown reports.

2 Resources

Slides: this is an extra lesson, so there aren’t currently slides available (yet!)

RStudio.Cloud: this is an extra lesson, so there isn’t an RStudio.Cloud project (yet!)

3 Packages

We’ll be covering the gt and tidyverse packages for displaying tables in R Markdown.

We will also import some actual stock data using quantmod and xts packages. This code was built using the example in Reproducible Finance with R by Jonathan K. Regenstein, Jr.

library(gt)

library(tidyverse)

library(glue)

library(readxl)

library(highcharter)

library(tidyquant)

library(timetk)

library(tibbletime)

library(quantmod)

library(PerformanceAnalytics)

library(scales)4 Stock data from quantmod

The code below collects stock data for five biotech companies:

Each of these companies are exchange-traded funds, or ETFs, and we can download their data using their unique ‘ticker’ symbols.

“ETFs are bought and sold throughout the day on stock exchanges.”

# put stock symbols in a vector

biotech_symbols <- c("BMRN", "NVS", "GSK", "AZN", "LLY")

# collect yahoo sales data

biotech_prices <- quantmod::getSymbols(biotech_symbols,

# returns an object with the opening price, closing price,

# adjusted price, daily high, daily low and daily volume

# for each ticker.

src = 'yahoo',

from = "2019-12-31", to = "2020-12-31",

auto.assign = TRUE,

warnings = FALSE) %>%

# Ad() and get() is used to isolate the adjusted price

purrr::map(~Ad(get(.))) %>%

# merge() looks for the date index shared by our objects and

# uses that index to align the data.

purrr::reduce(merge) %>%

# use colnames<- to rename the columns according to the

# symbols object.

`colnames<-`(biotech_symbols)

# check structure of biotech_prices

str(biotech_prices)## An 'xts' object on 2019-12-31/2020-12-29 containing:

## Data: num [1:252, 1:5] 84.6 84 84 84.6 84.2 ...

## - attr(*, "dimnames")=List of 2

## ..$ : NULL

## ..$ : chr [1:5] "BMRN" "NVS" "GSK" "AZN" ...

## Indexed by objects of class: [Date] TZ: UTC

## xts Attributes:

## List of 2

## $ src : chr "yahoo"

## $ updated: POSIXct[1:1], format: "2020-12-30 00:51:27"We can see this creates an xts or, extensible time-series object. A noteworthy difference between an xts and tibble dataset is that all xts objects have a date index.

The code below shows the attributes and structure of the first six items in biotech_prices:

unclass(head(biotech_prices))## BMRN NVS GSK AZN LLY

## [1,] 84.55 91.37416 44.72367 48.47673 128.8463

## [2,] 84.04 91.62505 44.65704 48.99202 129.6110

## [3,] 84.00 91.47066 44.23826 48.70035 129.1796

## [4,] 84.59 92.08825 44.25729 48.49617 129.6600

## [5,] 84.21 91.17152 43.98128 48.68090 129.9051

## [6,] 84.71 91.17152 44.17164 48.56423 131.0815

## attr(,"src")

## [1] "yahoo"

## attr(,"updated")

## [1] "2020-12-30 00:51:27 MST"

## attr(,"index")

## [1] 1577750400 1577923200 1578009600 1578268800 1578355200 1578441600

## attr(,"index")attr(,"tzone")

## [1] "UTC"

## attr(,"index")attr(,"tclass")

## [1] "Date"Read more about these objects here.

5 Convert xts prices data to wide

We want to take our xts data (biotech_prices) and convert it to a wide dataset of stock prices.

5.0.1 xts to data.frame

We can do this by combining the xts::to.monthly() function with base::data.frame(). We’ll use index(.) to shift the dates to a date column.

biotech_prices %>%

xts::to.monthly(indexAt = "lastof",

OHLC = FALSE) %>%

# convert the index to a date

base::data.frame(date = index(.))5.0.2 remove_rownames

Now that we have the dates stored in date, we want to drop the rownames with remove_rownames() and rearrange the data with select().

biotech_prices %>%

xts::to.monthly(indexAt = "lastof",

OHLC = FALSE) %>%

# convert the index to a date

base::data.frame(date = index(.)) %>%

# now remove the index because it got converted to row names

tibble::remove_rownames() %>%

dplyr::select(date,

dplyr::everything()) 5.0.3 create PricesWide

Assign this to PricesWide

biotech_prices %>%

xts::to.monthly(indexAt = "lastof",

OHLC = FALSE) %>%

# convert the index to a date

base::data.frame(date = index(.)) %>%

# now remove the index because it got converted to row names

tibble::remove_rownames() %>%

dplyr::select(date,

dplyr::everything()) -> PricesWide

PricesWide6 Calculate log returns

With the PricesWide dataset, we can create a wide dataset of log returns. This involves log() transforming the prices, and calculating the month-to-month difference.

6.1 Convert wide to long

We’ll want PricesWide in a long format to calculate the return variable.

6.1.1 pivot_longer

First we need to pivot the data from wide to long with tidyr::pivot_longer().

PricesWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "prices",

cols = -date)Now we can see the stock symbols have been moved into asset and all the prices have been stacked in prices.

6.1.2 group by asset (Symbols)

To calculate the returns, we group by the stock symbols in asset, then use mutate() to calculate the difference between log(prices) and log(lag(prices))

We can use log() and lag() inside mutate() to calculate returns.

PricesWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "prices",

cols = -date) %>%

# group by asset

dplyr::group_by(asset) %>%

# calculate log returns and add those returns to the data frame

dplyr::mutate(returns = (log(prices) - log(lag(prices))))Notice all the data are missing from 2019-12-31? Well, this makes sense if you know how dplyr::lag() works. The next section walks through an example.

6.2 Differences with dplyr::lag()

The dplyr::lag() function is great for calculating changes across time-series. We want to use it to calculate returns, which is the difference in price from month-to-month.

6.2.1 Create bmrn_prices

To demonstrate how dplyr::lag() works, we’ll look at a small subset of BMRN prices (in bmrn_prices).

bmrn_prices <- c(83.50000, 90.37000, 84.50000,

92.02000, 106.55000, 123.34000)

bmrn_prices## [1] 83.50 90.37 84.50 92.02 106.55 123.34First we will use dplyr::lag() on the bmrn_prices

bmrn_prices - dplyr::lag(bmrn_prices)## [1] NA 6.87 -5.87 7.52 14.53 16.79Once again, we see only five values are returned (even though we started out with 6 elements in bmrn_prices).

6.2.2 lag() internals

We see missing data because dplyr::lag() works using the following combination of elements in the bmrn_prices vector:

# difference between 2 and 1

bmrn_prices[2] - bmrn_prices[1]## [1] 6.87# difference between 3 and 2

bmrn_prices[3] - bmrn_prices[2]## [1] -5.87# difference between 4 and 3

bmrn_prices[4] - bmrn_prices[3]## [1] 7.52# difference between 5 and 4

bmrn_prices[5] - bmrn_prices[4]## [1] 14.53# difference between 6 and 5

bmrn_prices[6] - bmrn_prices[5]## [1] 16.796.2.3 log() and lag()

And when we combine log() with mutate() function, the lag() function produces the following:

log(bmrn_prices) - log(dplyr::lag(bmrn_prices))## [1] NA 0.07906572 -0.06716082 0.08525441 0.14660841 0.14633041Notice the order of the log() vs. dplyr::lag()

# difference between log 2 and log 1

log(bmrn_prices[2]) - log(bmrn_prices[1])## [1] 0.07906572# log difference between log 3 and log 2

log(bmrn_prices[3]) - log(bmrn_prices[2])## [1] -0.06716082# difference between log 4 and log 3

log(bmrn_prices[4]) - log(bmrn_prices[3])## [1] 0.08525441# difference between log 5 and log 4

log(bmrn_prices[5]) - log(bmrn_prices[4])## [1] 0.1466084# difference between log 6 and log 5

log(bmrn_prices[6]) - log(bmrn_prices[5])## [1] 0.14633046.2.4 mutate() with lag()

Now we know why we see the following missing values in returns on 2019-12-31. These represent the fact we can’t calculate a difference without two values in prices.

PricesWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "prices",

cols = -date) %>%

# group by asset

dplyr::group_by(asset) %>%

# calculate log returns and add those returns to the data frame

dplyr::mutate(returns = (log(prices) - log(lag(prices))))6.3 Convert returns to wide

Now that we have converted the original xts data to a long (tidy) dataset with the returns and prices indexed by date and stock symbol (stored in asset). However, we want this converted back to a wide dataset.

6.3.1 remove prices

Before we convert the long data back to a wide dataset, we need to remove the prices column because this will be a dataset of returns (we can join these together later).

PricesWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "prices",

cols = -date) %>%

# group by asset

dplyr::group_by(asset) %>%

# calculate log returns and add those returns to the data frame

dplyr::mutate(returns = (log(prices) - log(lag(prices)))) %>%

# remove prices

dplyr::select(-prices) 6.3.2 pivot_wider

Now we can restructure (or pivot_wider()) the data and place the stock symbols in each column.

PricesWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "prices",

cols = -date) %>%

# group by asset

dplyr::group_by(asset) %>%

# calculate log returns and add those returns to the data frame

dplyr::mutate(returns = (log(prices) - log(lag(prices)))) %>%

dplyr::select(-prices) %>%

# restructure to wide

tidyr::pivot_wider(names_from = asset,

values_from = returns)6.3.3 create ReturnsWide

The output looks correct, so we will assign the data to ReturnsWide.

PricesWide %>%

tidyr::pivot_longer(names_to = "asset",

values_to = "prices",

cols = -date) %>%

dplyr::group_by(asset) %>%

dplyr::mutate(returns = (log(prices) - log(lag(prices)))) %>%

dplyr::select(-prices) %>%

tidyr::pivot_wider(names_from = asset,

values_from = returns) -> ReturnsWide

ReturnsWide7 Combine prices and returns

Now that we have two wide datasets for (PricesWide and ReturnsWide), we will convert them to long and join them into a single dataset with both prices and returns.

7.1 Tidy adjusted prices & log returns

We’ve already covered the tidyr::pivot_longer() function, but just remember this function requires two columns: one for names_to (asset) and one for values_to (adj_prices)

7.1.1 Create PricesTidy

Below we pivot PricesWide into a long format dataset with date, asset, and adj_prices–we will call this PricesTidy.

PricesWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "adj_prices",

cols = -date) -> PricesTidy

PricesTidy7.1.2 Create ReturnsTidy

We repeat the process from above, but this time we assign the names_to as asset and the values_to as log_returns.

ReturnsWide %>%

# shift to long

tidyr::pivot_longer(names_to = "asset",

values_to = "log_returns",

cols = -date) -> ReturnsTidy

ReturnsTidy7.1.3 Join tidy datasets

Now we can join the two Tidy datasets together on date and asset and name the full dataset BioTechTidy.

inner_join(x = PricesTidy,

y = ReturnsTidy,

by = c("date", "asset")) %>%

filter(!is.na(log_returns)) -> BioTechTidy

BioTechTidy8 gt package

The gt package comes from RStudio and it’s philosophy is straightforward: tables can be assembled from their various parts,

the table header, the stub, the column labels and spanner column labels, the table body, and the table footer.

8.1 The basics

We will start by using the gt package with our biotech stock data.

8.1.1 Remove missing returns

We’ll only be displaying data for 2020, so we will filter out the row for 2019-12-31.

# remove missing

PricesWide <- PricesWide %>% filter(date != "2019-12-31")

PricesWide8.1.2 Create begin and end dates

We will also create two date vectors (begin_date and end_date) to use in the table title.

begin_date <- min(PricesWide$date)

begin_date## [1] "2020-01-31"end_date <- max(PricesWide$date)

end_date## [1] "2020-12-31"8.1.3 The gt table header

We will pass the PricesWide data to gt() and tag_header() functions to create a basic gt table. We use the glue::glue() function to create the subtitle.

See the code below to understand how glue::glue() works.

# recall we've created begin_date and end_date

glue::glue("From {begin_date} to {end_date}")## From 2020-01-31 to 2020-12-31Now we create a gt table with a header defined by tab_header()

PricesWide %>%

# create gt table

gt() %>%

# create header

tab_header(

title = "Adjusted Prices for BioTech Stocks",

subtitle = glue::glue("From {begin_date} to {end_date}")) | Adjusted Prices for BioTech Stocks | |||||

|---|---|---|---|---|---|

| From 2020-01-31 to 2020-12-31 | |||||

| date | BMRN | NVS | GSK | AZN | LLY |

| 2020-01-31 | 83.50 | 91.20046 | 44.54283 | 47.34891 | 136.8949 |

| 2020-02-29 | 90.37 | 81.01990 | 39.11396 | 43.45262 | 124.2914 |

| 2020-03-31 | 84.50 | 82.45000 | 36.56619 | 44.30580 | 136.6979 |

| 2020-04-30 | 92.02 | 84.73000 | 40.60016 | 51.86537 | 152.3858 |

| 2020-05-31 | 106.55 | 87.43000 | 40.90715 | 54.16697 | 151.4300 |

| 2020-06-30 | 123.34 | 87.34000 | 39.80446 | 52.47053 | 162.5484 |

| 2020-07-31 | 119.81 | 82.14000 | 39.34581 | 55.33761 | 148.7964 |

| 2020-08-31 | 78.03 | 86.06000 | 39.09855 | 56.00000 | 147.6314 |

| 2020-09-30 | 76.08 | 86.96000 | 37.16337 | 54.80000 | 147.2633 |

| 2020-10-31 | 74.43 | 78.08000 | 32.99681 | 50.16000 | 129.7931 |

| 2020-11-30 | 78.70 | 90.83000 | 36.79000 | 52.94000 | 145.6500 |

| 2020-12-31 | 86.18 | 93.35000 | 36.98000 | 49.90000 | 166.5800 |

gt::tab_header() controls the table header (which was one of the table parts we introduced into the philosophy).

8.2 Formatting with gt

The formatting functions in gt start with a fmt_ prefix. Some of the options include fmt_number, fmt_date, and fmt_currency.

8.2.1 Format numbers

We will use gt::fmt_number() to reduce the decimal places down to 2 in the stock symbol columns. We give the columns we want formatted to the columns = vars() argument.

PricesWide %>%

# create gt table

gt() %>%

# create header

tab_header(

title = "Adjusted Prices for BioTech Stocks",

subtitle = glue::glue("From {begin_date} to {end_date}")) %>%

# format number

fmt_number(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

decimals = 2

)| Adjusted Prices for BioTech Stocks | |||||

|---|---|---|---|---|---|

| From 2020-01-31 to 2020-12-31 | |||||

| date | BMRN | NVS | GSK | AZN | LLY |

| 2020-01-31 | 83.50 | 91.20 | 44.54 | 47.35 | 136.89 |

| 2020-02-29 | 90.37 | 81.02 | 39.11 | 43.45 | 124.29 |

| 2020-03-31 | 84.50 | 82.45 | 36.57 | 44.31 | 136.70 |

| 2020-04-30 | 92.02 | 84.73 | 40.60 | 51.87 | 152.39 |

| 2020-05-31 | 106.55 | 87.43 | 40.91 | 54.17 | 151.43 |

| 2020-06-30 | 123.34 | 87.34 | 39.80 | 52.47 | 162.55 |

| 2020-07-31 | 119.81 | 82.14 | 39.35 | 55.34 | 148.80 |

| 2020-08-31 | 78.03 | 86.06 | 39.10 | 56.00 | 147.63 |

| 2020-09-30 | 76.08 | 86.96 | 37.16 | 54.80 | 147.26 |

| 2020-10-31 | 74.43 | 78.08 | 33.00 | 50.16 | 129.79 |

| 2020-11-30 | 78.70 | 90.83 | 36.79 | 52.94 | 145.65 |

| 2020-12-31 | 86.18 | 93.35 | 36.98 | 49.90 | 166.58 |

8.2.2 Format dates

We can change the dates in date using the gt::fmt_date(). The columns argument needs vars(date), and

PricesWide %>%

# create gt table

gt() %>%

tab_header(

title = "Adjusted Prices for BioTech Stocks",

subtitle = glue::glue("From {begin_date} to {end_date}")) %>%

# format numbers

fmt_number(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

decimals = 2

) %>%

# format date

fmt_date(

columns = vars(date),

date_style = 5

) | Adjusted Prices for BioTech Stocks | |||||

|---|---|---|---|---|---|

| From 2020-01-31 to 2020-12-31 | |||||

| date | BMRN | NVS | GSK | AZN | LLY |

| January 31, 2020 | 83.50 | 91.20 | 44.54 | 47.35 | 136.89 |

| February 29, 2020 | 90.37 | 81.02 | 39.11 | 43.45 | 124.29 |

| March 31, 2020 | 84.50 | 82.45 | 36.57 | 44.31 | 136.70 |

| April 30, 2020 | 92.02 | 84.73 | 40.60 | 51.87 | 152.39 |

| May 31, 2020 | 106.55 | 87.43 | 40.91 | 54.17 | 151.43 |

| June 30, 2020 | 123.34 | 87.34 | 39.80 | 52.47 | 162.55 |

| July 31, 2020 | 119.81 | 82.14 | 39.35 | 55.34 | 148.80 |

| August 31, 2020 | 78.03 | 86.06 | 39.10 | 56.00 | 147.63 |

| September 30, 2020 | 76.08 | 86.96 | 37.16 | 54.80 | 147.26 |

| October 31, 2020 | 74.43 | 78.08 | 33.00 | 50.16 | 129.79 |

| November 30, 2020 | 78.70 | 90.83 | 36.79 | 52.94 | 145.65 |

| December 31, 2020 | 86.18 | 93.35 | 36.98 | 49.90 | 166.58 |

8.2.3 Format currency

We also want to makes sure the numbers are formatted as USD with gt::fmt_currency()

PricesWide %>%

# create gt table

gt() %>%

tab_header(

title = "Adjusted Prices for BioTech Stocks",

subtitle = glue::glue("From {begin_date} to {end_date}")) %>%

# format numbers

fmt_number(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

decimals = 2

) %>%

# format date

fmt_date(

columns = vars(date),

date_style = 5

) %>%

# format currency

fmt_currency(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

currency = "USD")| Adjusted Prices for BioTech Stocks | |||||

|---|---|---|---|---|---|

| From 2020-01-31 to 2020-12-31 | |||||

| date | BMRN | NVS | GSK | AZN | LLY |

| January 31, 2020 | $83.50 | $91.20 | $44.54 | $47.35 | $136.89 |

| February 29, 2020 | $90.37 | $81.02 | $39.11 | $43.45 | $124.29 |

| March 31, 2020 | $84.50 | $82.45 | $36.57 | $44.31 | $136.70 |

| April 30, 2020 | $92.02 | $84.73 | $40.60 | $51.87 | $152.39 |

| May 31, 2020 | $106.55 | $87.43 | $40.91 | $54.17 | $151.43 |

| June 30, 2020 | $123.34 | $87.34 | $39.80 | $52.47 | $162.55 |

| July 31, 2020 | $119.81 | $82.14 | $39.35 | $55.34 | $148.80 |

| August 31, 2020 | $78.03 | $86.06 | $39.10 | $56.00 | $147.63 |

| September 30, 2020 | $76.08 | $86.96 | $37.16 | $54.80 | $147.26 |

| October 31, 2020 | $74.43 | $78.08 | $33.00 | $50.16 | $129.79 |

| November 30, 2020 | $78.70 | $90.83 | $36.79 | $52.94 | $145.65 |

| December 31, 2020 | $86.18 | $93.35 | $36.98 | $49.90 | $166.58 |

8.3 Column labels

We have two different categories of variables in the PricesWide dataset, dates (i.e. months) and stock symbols. Adding a label above each group of columns would make the table easier to read. In the gt package philosophy, these are called spanner columns.

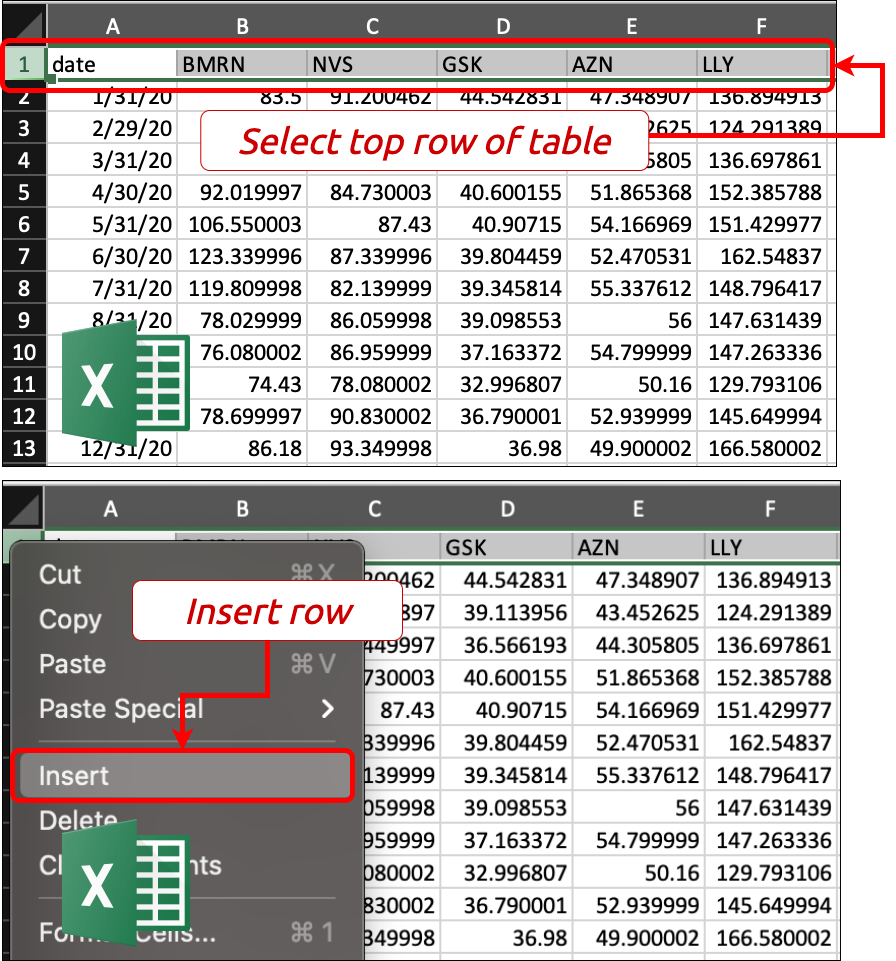

8.3.1 Column labels (Excel #1)

In Excel, adding a label for a group of columns usually involves inserting a row above the date and stock symbol columns,

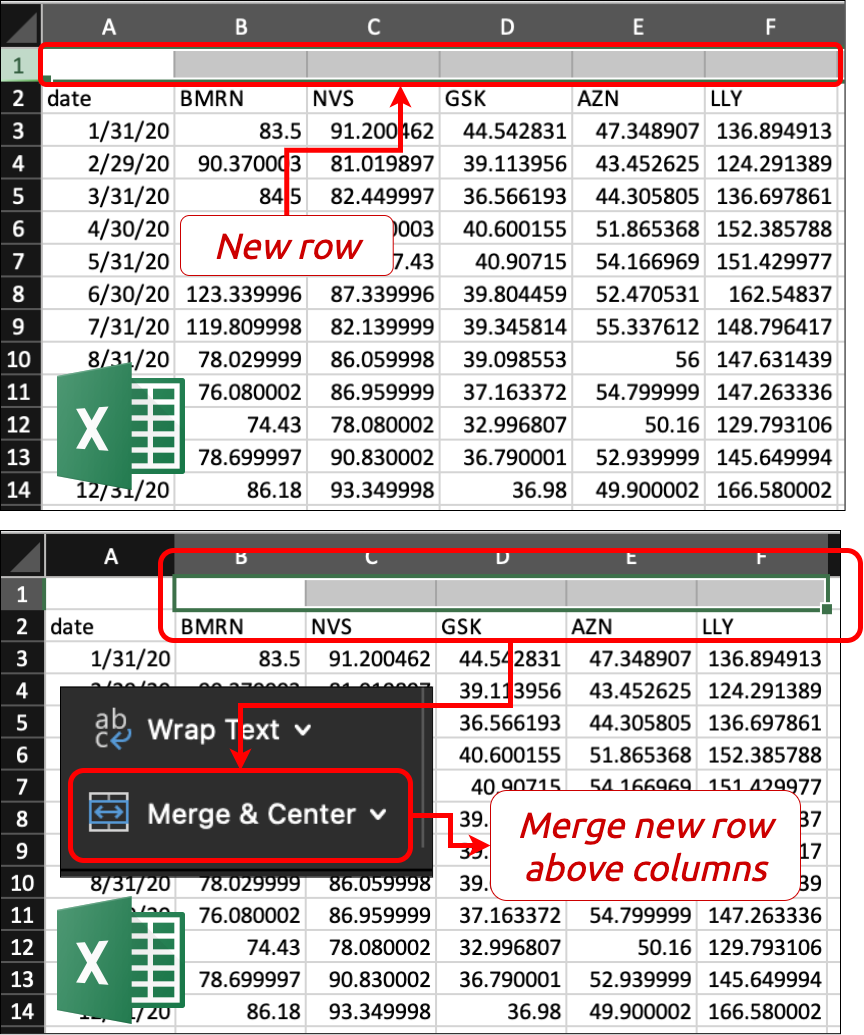

8.3.2 Column labels (Excel #2)

The next step is merging the columns above each respective column type…

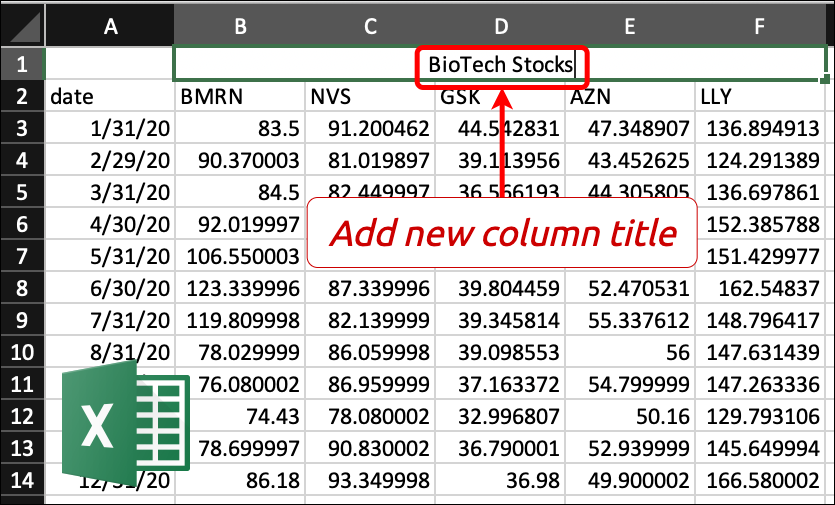

8.3.3 Column labels (Excel #3)

Finally, we add a new title in the merged rows (above our respective columns).

8.3.4 Column labels (gt)

In gt, we can add a spanner column with tab_spanner(). We give this function a label (like the example above) and the columns we want to include under the label.

PricesWide %>%

# create gt table

gt() %>%

# create header

tab_header(

title = "Adjusted Prices for BioTech Stocks",

subtitle = glue::glue("From {begin_date} to {end_date}")) %>%

# format numbers

fmt_number(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

decimals = 2

) %>%

# format date

fmt_date(

columns = vars(date),

date_style = 5

) %>%

# format currency

fmt_currency(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

currency = "USD") %>%

# add spanner column label

tab_spanner(

label = "BioTech Stocks",

columns = vars(BMRN, NVS, GSK, AZN, LLY)

)| Adjusted Prices for BioTech Stocks | |||||

|---|---|---|---|---|---|

| From 2020-01-31 to 2020-12-31 | |||||

| date | BioTech Stocks | ||||

| BMRN | NVS | GSK | AZN | LLY | |

| January 31, 2020 | $83.50 | $91.20 | $44.54 | $47.35 | $136.89 |

| February 29, 2020 | $90.37 | $81.02 | $39.11 | $43.45 | $124.29 |

| March 31, 2020 | $84.50 | $82.45 | $36.57 | $44.31 | $136.70 |

| April 30, 2020 | $92.02 | $84.73 | $40.60 | $51.87 | $152.39 |

| May 31, 2020 | $106.55 | $87.43 | $40.91 | $54.17 | $151.43 |

| June 30, 2020 | $123.34 | $87.34 | $39.80 | $52.47 | $162.55 |

| July 31, 2020 | $119.81 | $82.14 | $39.35 | $55.34 | $148.80 |

| August 31, 2020 | $78.03 | $86.06 | $39.10 | $56.00 | $147.63 |

| September 30, 2020 | $76.08 | $86.96 | $37.16 | $54.80 | $147.26 |

| October 31, 2020 | $74.43 | $78.08 | $33.00 | $50.16 | $129.79 |

| November 30, 2020 | $78.70 | $90.83 | $36.79 | $52.94 | $145.65 |

| December 31, 2020 | $86.18 | $93.35 | $36.98 | $49.90 | $166.58 |

8.4 Source notes and row groups

Inserting meta-data (more labels, footnotes, etc.) in Excel involves using the GUI to add rows or columns (following the steps outlined above). We’re going to cover how to include meta-data and row group labels in gt.

8.4.1 Source notes (gt)

It’s good practice to include the source of the data in a table display. In gt we can simply add a tab_source_note() function and include a text string for the source_note =.

PricesWide %>%

# create gt table

gt() %>%

# create header

tab_header(

title = "Adjusted Prices for BioTech Stocks",

subtitle = glue::glue("From {begin_date} to {end_date}")) %>%

# format numbers

fmt_number(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

decimals = 2

) %>%

# format date

fmt_date(

columns = vars(date),

date_style = 5

) %>%

# format currency

fmt_currency(

columns = vars(BMRN, NVS, GSK, AZN, LLY),

currency = "USD") %>%

# add spanner column label

tab_spanner(

label = "BioTech Stocks",

columns = vars(BMRN, NVS, GSK, AZN, LLY)

) %>%

# add data source

tab_source_note(

source_note = "Source: Yahoo finance data and xts package.")| Adjusted Prices for BioTech Stocks | |||||

|---|---|---|---|---|---|

| From 2020-01-31 to 2020-12-31 | |||||

| date | BioTech Stocks | ||||

| BMRN | NVS | GSK | AZN | LLY | |

| January 31, 2020 | $83.50 | $91.20 | $44.54 | $47.35 | $136.89 |

| February 29, 2020 | $90.37 | $81.02 | $39.11 | $43.45 | $124.29 |

| March 31, 2020 | $84.50 | $82.45 | $36.57 | $44.31 | $136.70 |

| April 30, 2020 | $92.02 | $84.73 | $40.60 | $51.87 | $152.39 |

| May 31, 2020 | $106.55 | $87.43 | $40.91 | $54.17 | $151.43 |

| June 30, 2020 | $123.34 | $87.34 | $39.80 | $52.47 | $162.55 |

| July 31, 2020 | $119.81 | $82.14 | $39.35 | $55.34 | $148.80 |

| August 31, 2020 | $78.03 | $86.06 | $39.10 | $56.00 | $147.63 |

| September 30, 2020 | $76.08 | $86.96 | $37.16 | $54.80 | $147.26 |

| October 31, 2020 | $74.43 | $78.08 | $33.00 | $50.16 | $129.79 |

| November 30, 2020 | $78.70 | $90.83 | $36.79 | $52.94 | $145.65 |

| December 31, 2020 | $86.18 | $93.35 | $36.98 | $49.90 | $166.58 |

| Source: Yahoo finance data and xts package. | |||||

8.4.2 Stub heads and row groups (gt)

Another way to add a label for particular columns is to use the tab_stubhead() or tab_row_group() functions.

tab_stubhead() takes a label argument and gets the name of the column we want to insert the label above. tab_row_group() takes a group argument, which is the name of the label for the groups of rows, and the rows argument which can be either 1) a vector of rows inside c(), 2) a tidyselect helper function, or 3) a set of row indexes (we use this one).

We’re going to demonstrate the tab_stubhead() and tab_row_group() functions, we’re going to use the BioTechTidy dataset we created earlier.

BioTechTidy %>%

# cleaner column names

select(

Date = date,

`Stock Symbol` = asset,

`Adjusted Prices` = adj_prices,

`log(Returns)` = log_returns) %>%

# create gt table

gt() %>%

# create table header

tab_header(

title = "BioTech Stock Prices and Returns",

subtitle = "Ajusted monthly prices and log-adjusted returns") %>%

# add stubhead for Date

tab_stubhead(label = "Date") %>%

# format numbers

fmt_number(

columns = vars(`Adjusted Prices`, `log(Returns)`),

decimals = 2

) %>%

# format date

fmt_date(

columns = vars(Date),

date_style = 5

) %>%

# format currency

fmt_currency(

columns = vars(`Adjusted Prices`, `log(Returns)`),

currency = "USD") %>%

# row group for quarter 4

tab_row_group(

group = "Quarter 4 (OCT - DEC)",

rows = 46:60) %>%

# row group for quarter 3

tab_row_group(

group = "Quarter 3 (JUL - SEP)",

rows = 31:45) %>%

# row group for quarter 2

tab_row_group(

group = "Quarter 2 (APR - JUN)",

rows = 16:30) %>%

# row group for quarter 1

tab_row_group(

group = "Quarter 1 (JAN - MAR)",

rows = 1:15) %>%

# add source of data

tab_source_note(

source_note = "Source: Yahoo finance data and xts package.") | BioTech Stock Prices and Returns | |||

|---|---|---|---|

| Ajusted monthly prices and log-adjusted returns | |||

| Date | Stock Symbol | Adjusted Prices | log(Returns) |

| Quarter 1 (JAN - MAR) | |||

| January 31, 2020 | BMRN | $83.50 | −$0.01 |

| January 31, 2020 | NVS | $91.20 | −$0.00 |

| January 31, 2020 | GSK | $44.54 | −$0.00 |

| January 31, 2020 | AZN | $47.35 | −$0.02 |

| January 31, 2020 | LLY | $136.89 | $0.06 |

| February 29, 2020 | BMRN | $90.37 | $0.08 |

| February 29, 2020 | NVS | $81.02 | −$0.12 |

| February 29, 2020 | GSK | $39.11 | −$0.13 |

| February 29, 2020 | AZN | $43.45 | −$0.09 |

| February 29, 2020 | LLY | $124.29 | −$0.10 |

| March 31, 2020 | BMRN | $84.50 | −$0.07 |

| March 31, 2020 | NVS | $82.45 | $0.02 |

| March 31, 2020 | GSK | $36.57 | −$0.07 |

| March 31, 2020 | AZN | $44.31 | $0.02 |

| March 31, 2020 | LLY | $136.70 | $0.10 |

| Quarter 2 (APR - JUN) | |||

| April 30, 2020 | BMRN | $92.02 | $0.09 |

| April 30, 2020 | NVS | $84.73 | $0.03 |

| April 30, 2020 | GSK | $40.60 | $0.10 |

| April 30, 2020 | AZN | $51.87 | $0.16 |

| April 30, 2020 | LLY | $152.39 | $0.11 |

| May 31, 2020 | BMRN | $106.55 | $0.15 |

| May 31, 2020 | NVS | $87.43 | $0.03 |

| May 31, 2020 | GSK | $40.91 | $0.01 |

| May 31, 2020 | AZN | $54.17 | $0.04 |

| May 31, 2020 | LLY | $151.43 | −$0.01 |

| June 30, 2020 | BMRN | $123.34 | $0.15 |

| June 30, 2020 | NVS | $87.34 | −$0.00 |

| June 30, 2020 | GSK | $39.80 | −$0.03 |

| June 30, 2020 | AZN | $52.47 | −$0.03 |

| June 30, 2020 | LLY | $162.55 | $0.07 |

| Quarter 3 (JUL - SEP) | |||

| July 31, 2020 | BMRN | $119.81 | −$0.03 |

| July 31, 2020 | NVS | $82.14 | −$0.06 |

| July 31, 2020 | GSK | $39.35 | −$0.01 |

| July 31, 2020 | AZN | $55.34 | $0.05 |

| July 31, 2020 | LLY | $148.80 | −$0.09 |

| August 31, 2020 | BMRN | $78.03 | −$0.43 |

| August 31, 2020 | NVS | $86.06 | $0.05 |

| August 31, 2020 | GSK | $39.10 | −$0.01 |

| August 31, 2020 | AZN | $56.00 | $0.01 |

| August 31, 2020 | LLY | $147.63 | −$0.01 |

| September 30, 2020 | BMRN | $76.08 | −$0.03 |

| September 30, 2020 | NVS | $86.96 | $0.01 |

| September 30, 2020 | GSK | $37.16 | −$0.05 |

| September 30, 2020 | AZN | $54.80 | −$0.02 |

| September 30, 2020 | LLY | $147.26 | −$0.00 |

| Quarter 4 (OCT - DEC) | |||

| October 31, 2020 | BMRN | $74.43 | −$0.02 |

| October 31, 2020 | NVS | $78.08 | −$0.11 |

| October 31, 2020 | GSK | $33.00 | −$0.12 |

| October 31, 2020 | AZN | $50.16 | −$0.09 |

| October 31, 2020 | LLY | $129.79 | −$0.13 |

| November 30, 2020 | BMRN | $78.70 | $0.06 |

| November 30, 2020 | NVS | $90.83 | $0.15 |

| November 30, 2020 | GSK | $36.79 | $0.11 |

| November 30, 2020 | AZN | $52.94 | $0.05 |

| November 30, 2020 | LLY | $145.65 | $0.12 |

| December 31, 2020 | BMRN | $86.18 | $0.09 |

| December 31, 2020 | NVS | $93.35 | $0.03 |

| December 31, 2020 | GSK | $36.98 | $0.01 |

| December 31, 2020 | AZN | $49.90 | −$0.06 |

| December 31, 2020 | LLY | $166.58 | $0.13 |

| Source: Yahoo finance data and xts package. | |||